2016 Art Market Roundup: Predictions for an Uncertain 2017

The uncertainty of the immediate future of politics and the worldwide economy is making predictions about the art market in 2017 a challenging task. Many events have already transpired or are still in the works. Past events, such as the UK’s vote to leave the European Union, the election of Donald Trump as US president, and forthcoming elections in Europe, which could see populist politicians take power, are overturning the established order and creating enormous ambiguity about the future. Predictions are shifting on a daily basis, and even my own predictions, which were previously published on Invaluable have changed. Originally, I predicted we would see more of the same from 2016, with a stable art market tied to both the stock market and US housing market; however, without a clear picture of the political and economic climate, and with so much unrest percolating throughout the world, a clear prediction is dubious.

As of today, only a little more than a week before his inauguration, President-elect Trump has yet to finalize his economic policies; however, it seems certain that he will reduce taxes for the wealthy and those in higher tax brackets. This could translate into a boost for the art market and overall US economy. Some changes, such as increased spending on infrastructure, could also produce substantial benefits. As 2016 drew to a close, stock exchanges in the US and worldwide were up, and the US housing market looked bright too. The results of the bellwether November auctions in New York were encouraging, albeit with reduced tallies compared with the same season in 2015, even more so compared with 2014. Its possible the legislation enacted by the incoming administration could continue the healthy confidence and steady trajectory we have seen within the last several years.

Despite any legislative changes, the polarization of wealth in the US seems sure to increase, and this could have a positive impact on art sales. Even with a rise in interest rates, art remains attractive as a tangible investment. However, the possible elimination of tax incentives for donating works of art to charity could have a discouraging effect on collectors. With eminent changes to the tax code sure to transpire, the ability to claim less deductions could translate to less art and money being donated to 501c3 art organizations that rely on those donations to operate and effect their communities positively. Regardless of these uncertainties, collectors will continue to favor art from certain popular periods; Impressionism, Modern and Contemporary art will continue to fetch the highest prices, and artist’s such as Andy Warhol, Pablo Picasso, Claude Monet and Jean-Michel Basquiat will be the most sought after signatures.

Contemporary art in particular will continue to grab the attention of many collectors. Contemporary art accounts for 12% of global Fine Art auction turnover, a substantial share and one that is largely attributable to just a handful of notable artists. Several Contemporary makers (artists born after 1945) are achieving almost the same prices as some of the most recognizable and sought-after artists in the world (of all periods combined) and the top 10 Contemporary artists all have places in the Top 100 artists by annual auction turnover, next to Roy Lichtenstein, Cy Twombly, Gerhard Richter and Lucian Freud. Despite its success, collectors of Contemporary art should proceed with measured caution as the memory of the global economic crisis of 2007-2008 fades. Big players, such as the major auctioneers and dealers in the worldwide markets, are restricting supply in order to protect existing price levels. This could prove beneficial to collectors or potential collectors in the short term, but may have a disastrous effect on values of certain artists in the long term.

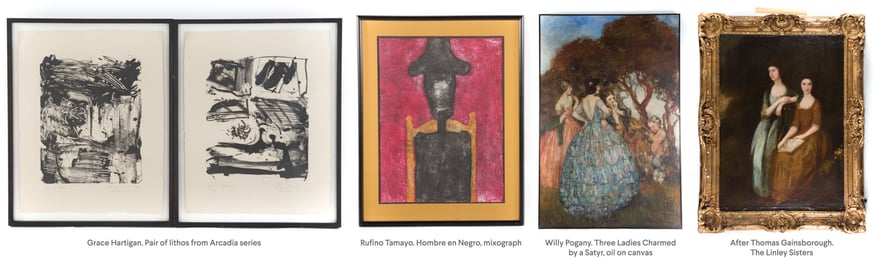

Alex Cooper is offering several lots to watch closely in the upcoming January sale. Hard to locate prints by Grace Hartigan from the Arcadia Series will be offered with an attractive estimate of $2,000-$4,000 (lots 2708 & 2709). Hartigan’s prints have been performing well over the past several years and works from this series will not disappoint. Other lots to take notice include 2705, Rufino Tamayo’s Hombre el Negro estimated at $2,000-$4,000, a large oil on canvas by Hungarian artist Willy Pogany (lot 2703, estimate: $2,000-$4,000), and a very early 20th Century copy of The Linley Sisters by Thomas Gainsborough (lot 2803, estimate: $700-$1,000). We are also offering prints by famed artists such as Andy Warhol, Marc Chagall, George Braque, Edouard Manet, Paul Cézanne, Pablo Picasso, Georges Rouault, Salvador Dali, J.A.M. Whistler, and Walter Henry Williams. Additionally, lots by notable Pop artists Peter Max, Leroy Neiman and Charles Fazzino will be highlighting the sale.

— Debrah Dunner

AM, M.A., accredited fine art appraiser and Owner of Aesthetica Art Services, LLC

Sources: